Investor Discontent and Calls for Change

A minority investor in Ubisoft has issued an open letter to the company’s board, expressing severe dissatisfaction with its current performance and strategic direction. Juraj Krupa from the Slovakian hedge fund AJ Investments and Partners threatens a shareholder coup against the Guillemot brothers, the founders of Ubisoft, and their financial backers at Tencent.

Concerns Over Company Performance

In his letter, Krupa cites delays in upcoming titles like Rainbow Six: Siege and The Division, along with a grim revenue forecast for Q2 2024, as key reasons for shareholder frustration. Since last year, Ubisoft’s stock has plummeted over 40%, prompting Krupa to demand either a private buyout or a sale to a strategic investor. He insists that the board must respond within 60 days.

Plans for a Proxy Fight

AJ Investments is actively engaging with other shareholders to initiate a proxy fight aimed at ousting the Guillemots. They plan to leverage French minority laws to gather sufficient support for a sale process that would enhance shareholder value. Krupa specifically calls for the removal of long-term CEO Yves Guillemot.

Management Criticism and Strategy Issues

Krupa claims that Ubisoft’s low valuation compared to peers is a result of mismanagement, asserting that shareholders are “held hostage” by the Guillemot family and Tencent. He criticizes the management’s focus on short-term financial performance over a long-term strategy that prioritizes exceptional gaming experiences.

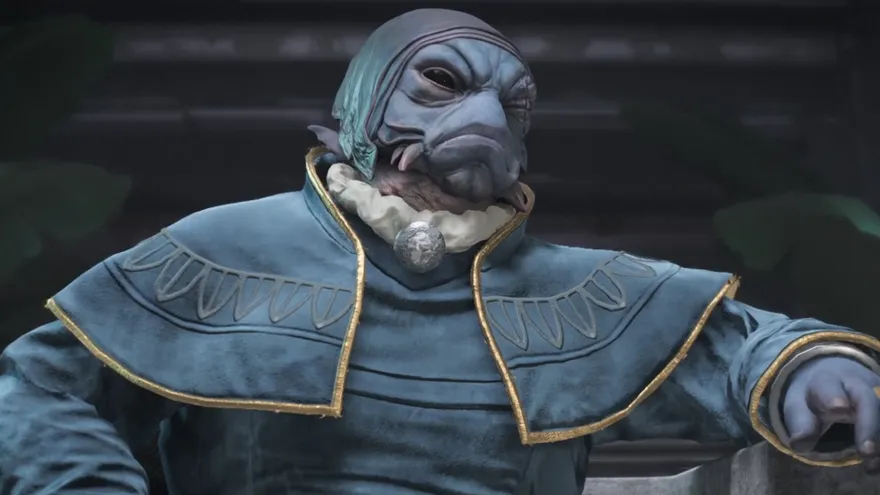

Frustration with Game Releases

Describing Ubisoft’s recent game releases as mediocre, Krupa highlights the cancellation of Division Heartland and the lackluster performance of titles like Skull and Bones and Prince of Persia: Lost Crown. He points out that beloved franchises like Rayman and Splinter Cell have been dormant for years, despite their popularity.

Accusations Against Tencent and the Guillemots

Krupa accuses Tencent and the Guillemot family of collaborating to prevent Ubisoft’s acquisition by private equity firms. He suggests that their strategy involves keeping the share price low to acquire more shares cheaply, potentially allowing them to gain full control over the company.

Proposed Changes and Layoffs

AJ Investments argues for significant cost reductions and staff optimization to enhance operational efficiency. They suggest that Ubisoft consider selling off certain studios that do not contribute to its core franchises, noting that the company’s structure is too large for its current profitability.

Future Leadership and Company Structure

Krupa envisions a new leadership structure where the Guillemots serve in advisory roles alongside a more efficient CEO. He believes that taking Ubisoft private would alleviate the pressure to deliver quarterly results, enabling the company to focus on long-term strategies for revitalizing its franchises.

Conclusion

This tumultuous situation at Ubisoft highlights the ongoing struggle between shareholder interests and company management. As the investor push for change intensifies, concerns grow for Ubisoft developers facing potential layoffs amid these corporate upheavals.